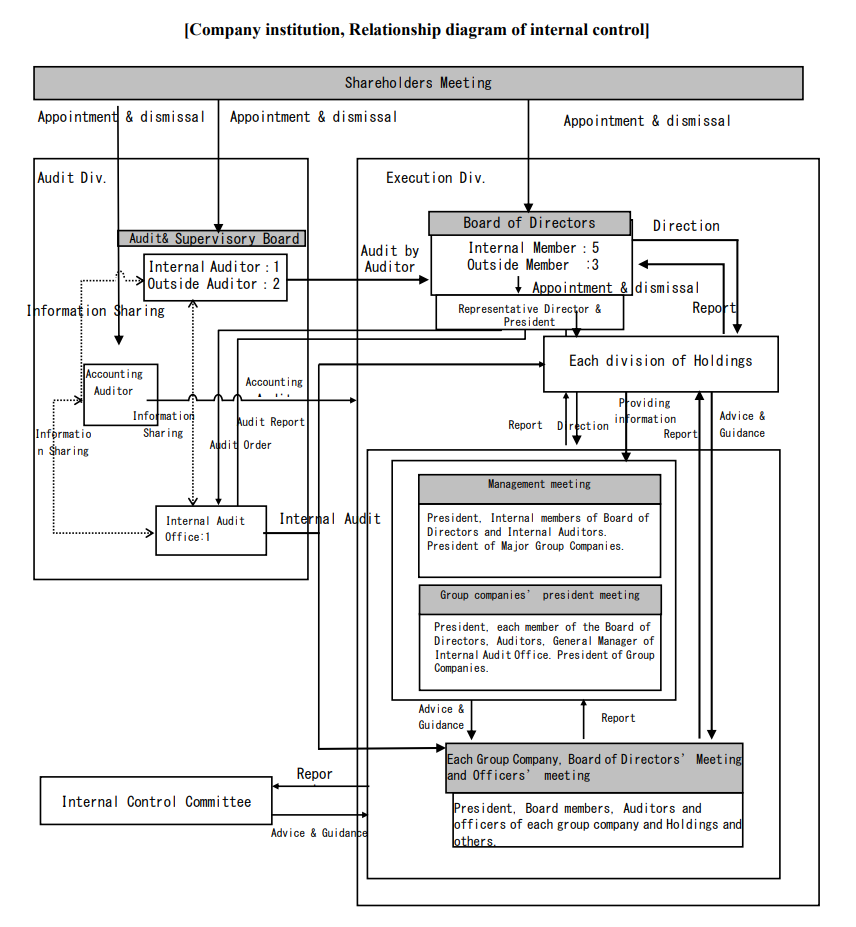

Our group aim to increase corporate value and become a company trusted by society by supplying products that can contribute to society. In order to realize that we believe that it is our responsibility as a listed company to build an efficient business management system and an effective system structure, and to maintain a suitable corporate governance structure to our group.

The important items for making a corporate governance system suitable for our group are as follows.

1. One is there is an organization that constantly monitors and supervises the appropriateness and legality of the management

decision-making process and the content of decisions, and moreover its effectiveness is guaranteed.

2. Another is the management decision-making body and the business execution body are clearly separated, and their responsibilities

are clear.

3. The other is appropriate internal control organizations and systems are in place and functioning effectively.

4. The other is that officers and employees recognize the importance of corporate ethics and compliance and establish it as a

corporate culture.

5. Last important thing is disclosing corporate management information to all stakeholders timely and appropriate manner.

Described based on the amendment after Jun. 2021.

[Supplementary Principle 2.4.1 Disclosure of goals and situations for ensuring diversity within the company, including promoting the active participation by women]

We are small but highly talented equipment manufacturers group with advanced technology, which is a sales point, and we value human resources who can contribute to our business regardless of gender, nationality, time of joining the company. We do not set specific numerical targets due to the nature of our business, but we will continue to improve our human resources development policy and internal environment to ensure diversity.

[Supplementary Principle 3.1.3 Disclosure on our sustainability efforts]

We have announced, "De-carbonization management" and "De-carbonization mass production new product development" as main items of future SDGs efforts in the financial results briefing materials, and other documents, and we will continue to consider disclosures that are more specific in the future. In addition, in order to develop human resources with excellent development, design, and manufacturing technologies that will be our core sustainable growth, we will strengthen our efforts to invest in human capital and enhance the superiority of our technology in the future. We will also strive to expand intellectual property that contributes to stable management. Regarding climate change initiatives, we are planning to answer the CDP Climate Change Questionnaire (simplified version), and taking this opportunity we will further proceed to consider so that we can disclose specific goals, roadmaps, and efforts in the future.

[Supplementary Principle 4.2.2. Role and Responsibilities of the Board of Directors to make basic policies on sustainability efforts and supervision of investment in human capital and intellectual property.]

We have established the "Group SDG Initiative Policy," "Environmental Philosophy," and "Environmental Policy," and we are formulating strategic activity goals and action plans that link to management through the activities of the SDGs Management Promotion Committee and the Environmental ISO Committee. Although we will make efforts to continue to consider so that we can disclose more advanced approach policies, goals, and concrete roadmaps for sustainability necessary for our sustainable growth. In addition, we will advance the sophistication of our business portfolio strategy, with ascertaining the scale of necessary human capital and intellectual property, and allocate it effectively.

[Supplementary Principle 4.3.2 ]

We nominate the appropriate person determined by mutual election of each director as the Representative Director and President, who is the chief executive officer, at the Board of Directors after the general meeting of shareholders. However, we will continue to consider a certain procedure that are objective, timely, and transparent.

[Supplementary Principle 4.3.3]

In the event that it is deemed necessary for us to dismiss the Chief Executive Officer, the Board of Directors will make a decision after deliberation, but in the future, we will take further objective, timely and transparent procedure.

[Supplementary Principle 4.10.1 Appropriate involvement and advice by establishing an independent nominating committee and compensation committee]

We are a company with auditors, and have two independent outside corporate auditors and three independent outside directors and we seeks their opinions and advice from an independent standpoint regarding important matters such as nominations and remuneration at the Board of Directors. In addition, in the voluntary remuneration committee three independent outside directors are members as well too to strengthen the management and supervision function. We will continue to consider establishing a voluntary nominating committee. We believe that the independence of the members of the committee is appropriate for the current size of the company. However, in the future, as the size of the company expands, we will review the composition of outside directors and consider regarding independence.

[Principle 4.11 Preconditions for Board and Kansayaku Board Effectiveness]

The Board of Directors of the Company is composed of persons with specialized knowledge and abundant experience in the field of responsibility. In addition, at least more than one person with appropriate knowledge of finance and accounting shall be appointed to the Board of Corporate Auditors of the Company. At the moment, there are no female or foreign directors, but we will continue to consider ensuring diversity in terms of gender and internationality.

[Principle 5.2 Establishing and Disclosing Business Strategies and Business Plans]

The Company announced its medium-term management plan on March 19, 2021. In the future, at financial results briefings, we explain the current achievement status and goals.

In addition, we will strive to review various items including cost of capital and allocation of management resources to investment as appropriate, which are highly effective, and contribute to investors who aim medium- to long-term investment.

[Supplementary Principle5.2.1 Disclosure of basic policy and review status regarding business portfolio at the time of planning and publication of management strategy.]

The Group's business is divided into four segments (mechatronics-related, display-related, industrial machineries-related, and electronics-related), and each business segment alone or collaborates with other business segment to manufacture and sell products and provide solutions that meet the needs of our clients. However, we will consider which business to focus on allocating management resources so that we can publicize the policy and situation to stakeholders in an easy-to-understand manner.

[Principle 1.4 Cross-Shareholdings]

The Company holds shares, to a limited extent, with a policy for the purpose of maintaining and strengthening smooth business operations and business relationships and facilitating sales activities. If there is a need for new holdings in the future, we will take measures such as considering the purpose of holding and the cost of capital. We are reviewing the shares we hold as appropriate with considering changes in the business environment. Regarding the voting rights of the shares held, we respect the management policies of the investees and exercise them by comprehensively judging whether their proposals would contribute to the sustainable growth of the Company and the improvement of corporate value over the medium to long term. If a company that holds the Company's shares as strategically held shares, (Cross-Shareholding Holders) indicates an intention to sell the shares or suggest a reduction in transactions we will not interfere with the sale of those shares. In addition, there are no cases that is Cross-Shareholding Holders who have business transactions, and there is no impact on transactions.

[Principle 1.7 Related Party Transactions]

The Company requires deliberation and resolution by the Board of Directors regarding transactions between related parties. Such resolution is made with excluding the relevant officers as special stakeholders from the quorum of the resolution.

[Supplementary principle 2.4.1 Disclosure of goals and situations for ensuring diversity within the company, including promoting the active participation of women]

It is described in the above "Reason for not implementing each principle of the Corporate Governance Code".

[Principle 2.6 Roles of Corporate Pension Funds as Asset Owners]

We have joined the National Printing and Binding Machinery Company Pension Fund and outsourced its pension management. Regarding the operational status, the executive officer and person in charge of the Finance Department and the person in charge of the Human resource and General Affairs Department checks and confirms the overall soundness of the fund's operation.

[Principle 3.1 Full Disclosure]

(1) The corporate philosophy and financial results presentation materials are posted on our website.

Corporate philosophy: https://www.yac.co.jp/ja/company/vision.html

Financial results presentation : https://www.yac.co.jp/ja/ir/library.html

(2) The basic concept of corporate governance is disclosed in the Corporate Governance Report and Annual Securities Report.

(3) The executives and officers compensation of the Company and its subsidiaries are "fixed compensation,"

"performance-linked compensation," and "stock compensation with transfer restrictions," and each compensation figure is

determined based on the compensation guidelines by position and company size, which is decided by Board of Directors.

For "fixed compensation," the compensation amount for each individual is determined by an arbitrary compensation committee

(including outside directors) entrusted by the board of directors based on the budget of each company, and the results are reported

to the board of directors.

For "performance-linked compensation," the compensation committee will determine the amount of compensation for each

individual according to the degree of achievement of the full-year budget for each company.

Results are reported to the board of directors.

The purpose of "Restricted Share Compensation" is to share the merits and risks of stock price fluctuations with shareholders,

and to increase the willingness to contribute to the rise in stock prices and the improvement of corporate value over the medium to

long term as a group. The number of shares to be granted for each individual is decided by the Compensation Committee.

(4) The policy for the appointment and dismissal of directors and corporate auditors is not stipulated in internal rules. We

comprehensively judge whether they have the ability and the qualities to properly carry out the management of our company with a

duty of care as a prudent manager in business execution and in order to contribute to the improvement of corporate value and the

medium to long-term Company's sustainable growth.

(5) The reasons for appointing candidates for directors and candidates for outside corporate auditors are disclosed in the notice of

convocation of the general meeting of shareholders.

[Supplementary Principle 3.1.3 Disclosure of our company's sustainability efforts]

It is described in the above "Reason for not implementing each principle of the Corporate Governance Code".

[Supplementary Principle 4.1.1]

The Company has established the Board of Directors Regulations, Duties Division Regulations, and Duties Authority Regulations,

and stipulates matters to be resolved by the Board of Directors, matters that can be settled by each director, and matters that can be

decided according to each position. Based on these, the Board of Directors decides management policies and important matters,

and based on these policies, the member of the board and operating officers in charge of business execution carry out the

business.

[Principle 4.9 Independence Standards and Qualification for Independent Directors]

The Company selects independent outside directors based on the Companies Act and the standards regulated by the Tokyo Stock

Exchange. Independent outside directors are appointed a person who have a high degree of independence without the risk of

conflict of interest with general shareholders. All three independent outside directors of the Company have been notified to the

Tokyo Stock Exchange as independent officers.

[Supplementary Principle 4.10.1 Appropriate involvement and advice by establishing an independent nominating committee and

compensation committee]

It is described in the above "Reason for not implementing each principle of the Corporate Governance Code".

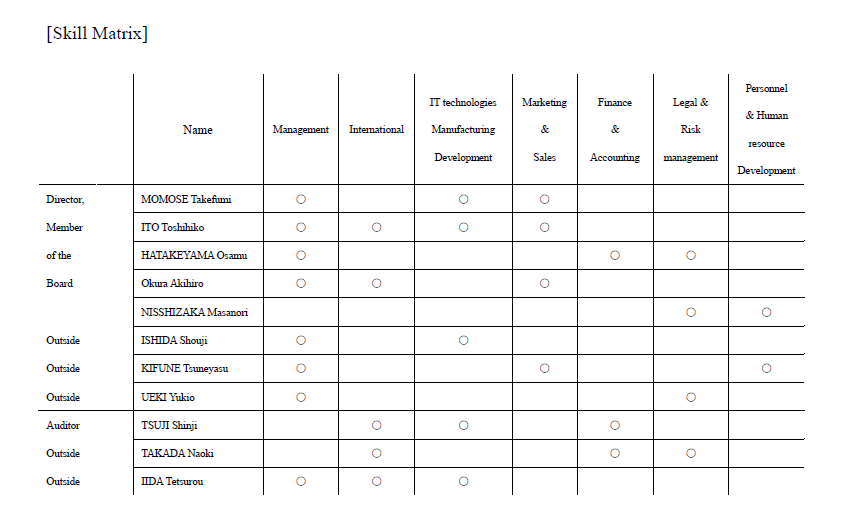

[Supplementary Principle 4.11.1]

The Board of Directors of the Company is composed of directors with different expertise and experience, and we have a policy of

maintaining an appropriate number of members who can hold effective and efficient discussions and make swift decisions. The skill matrix is attached at the end of this report.

[Supplementary Principle 4.11.2]

The directors and corporate auditors of the Company devote sufficient time and effort to properly fulfill their respective roles and responsibilities. In addition, the status of concurrent position is posted in the notice of convocation of the general meeting of shareholders and the annual securities report.

[Supplementary Principle 4.11.3]

The effectiveness of the entire Board of Directors of the Company is analyzed and evaluated on a regular basis and published on the Company's website.

Effectiveness evaluation: https://www.yac.co.jp/ja/ir/news.html

[Supplementary Principle 4.14.2]

The member of the board of the Company utilize external training and seminars such as seminars hosted by consulting companies and securities agency organizations to acquire the necessary knowledge as directors.

In addition, full-time corporate auditors participate in external training and seminars by the Japan Corporate Auditors Association, and strive to acquire the knowledge necessary for corporate auditors and promote understanding of the roles and responsibilities of corporate auditors. To the outside directors and outside corporate auditors, we provide appropriate presentation on the Company's management strategy, business content, finance, organization, etc. so that they can fulfill their roles, and provide a place to fully share information.

[Principle 5.1 Policy for Constructive Dialogue with Shareholders]

We appoint a manager in charge of IR, and the Management Promotion Department is managing IR. For institutional investors, in addition to holding financial results presentation meeting, we also hold individual IRs face-to-face meetings. For shareholders, we post financial results presentation materials in Japanese and English on our website, and we also hold company briefing sessions for individual investors.

The Management Promotion Department handles dialogues (interviews) with shareholders. In addition, we reasonably judge the wishes of shareholders, the main concerns of interviews and the number of shares held by shareholders, in addition, the president and the manager in charge of IR will respond to the interview as necessary.

< Definition of each item>

*Management: Having experience in corporate management.

(A person who has experience of Representative Director, CEO or COO or job title equivalent to them.)

*International: Having knowledge and experience regarding sales, manufacturing, and development with foreign customers or overseas markets related to the Group's business.

*IT technologies, manufacturing and development: Having knowledge and experience in manufacturing and development in the Group, other manufacturing industries, and IT industry.

*Marketing and Sales: Having knowledge and experience in sales and marketing in the Group and other manufacturing industries.

*Finance and Accounting: Having knowledge and experience in accounting and finance, settlement of accounts, dialogue with capital markets.

*Legal and Risk Management: Having knowledge of legal affairs, risk management, compliance.

* Personnel / human resources development: Having knowledge and experience in personnel management, human resource development, and recruitment and employee welfare.